Applying for an instant personal loan online has become very easy in India. With the help of banks and loan apps, you can now get money directly into your bank account within minutes, without visiting any branch.

Below is a complete explanation to help you understand the process clearly.

What Is an Instant Personal Loan?

An instant personal loan is an unsecured loan that you can apply for online and get approved quickly. It does not require any collateral like gold or property. These loans are mainly used for:

- Medical emergencies

- Education expenses

- Wedding or travel

- Bill payments

- Personal needs

Benefits of Applying Instant Personal Loan Online

Applying online has many advantages:

- ✅ Quick approval (within minutes)

- ✅ Minimal documentation

- ✅ No collateral required

- ✅ 100% online process

- ✅ Flexible repayment options

- ✅ Available for salaried & self-employed

Eligibility Criteria for Instant Personal Loan

Before applying, you should check whether you meet the basic eligibility:

General Eligibility

- Age: 21 to 60 years

- Citizenship: Indian resident

- Monthly income: As per lender requirement

- Employment: Salaried or self-employed

- Credit score: Preferably 650 or above

Some loan apps also provide loans to users with low or no CIBIL score, but at a higher interest rate.

Documents Required for Instant Personal Loan

Most online loan platforms ask for very few documents:

- Aadhaar Card

- PAN Card

- Bank account details

- Income proof (salary slip or bank statement – optional for some apps)

👉 Many instant loan apps offer loans without physical documents.

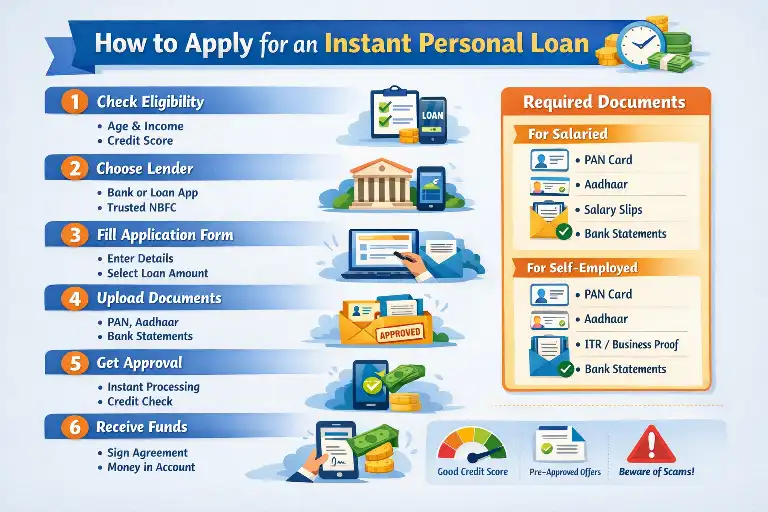

How to Apply Instant Personal Loan Online – Step by Step

Follow these steps carefully:

Step 1: Choose a Bank or Loan App

Select a trusted bank or instant loan app based on:

- Interest rate

- Loan amount

- Processing fees

- Customer reviews

Step 2: Visit the Official Website or App

Go to the official website or download the mobile app from the Play Store.

Step 3: Fill the Online Application Form

Enter basic details such as:

- Name

- Mobile number

- Date of birth

- Employment type

- Monthly income

Step 4: Upload Documents

Upload digital copies of:

- Aadhaar card

- PAN card

- Bank statement (if required)

Step 5: Verify Your Details

Verification may include:

- OTP verification

- Video KYC

- Bank account verification

Step 6: Loan Approval

After verification:

- Your loan eligibility is checked

- Interest rate is shown

- Loan amount is approved instantly

Step 7: Loan Disbursement

Once approved:

- Loan agreement is accepted digitally

- Money is transferred to your bank account

- Amount is usually credited within minutes to 24 hours

Interest Rate and Charges

Interest rates depend on:

- Credit score

- Income

- Loan amount

- Loan tenure

Common Charges Include:

- Interest rate: Varies by lender

- Processing fee

- Late payment charges

- GST on fees

Always read the terms carefully before accepting the loan.

Best Tips to Get Instant Loan Approval

- Maintain a good credit score

- Provide correct details

- Choose the right loan amount

- Avoid multiple loan applications at once

- Repay existing EMIs on time

Common Reasons for Loan Rejection

Your loan application may be rejected due to:

- Low CIBIL score

- Incorrect information

- Low income

- Existing unpaid loans

- Unstable employment

Is It Safe to Apply Instant Personal Loan Online?

Yes, it is safe if you:

- Apply through RBI-registered banks or NBFCs

- Avoid fake loan apps

- Read privacy policies carefully

- Do not share OTP or sensitive details

Conclusion

Applying for an instant personal loan online is fast, convenient, and hassle-free. By choosing the right lender and following the correct steps, you can get quick financial support whenever needed. Always compare interest rates and read loan terms before applying.