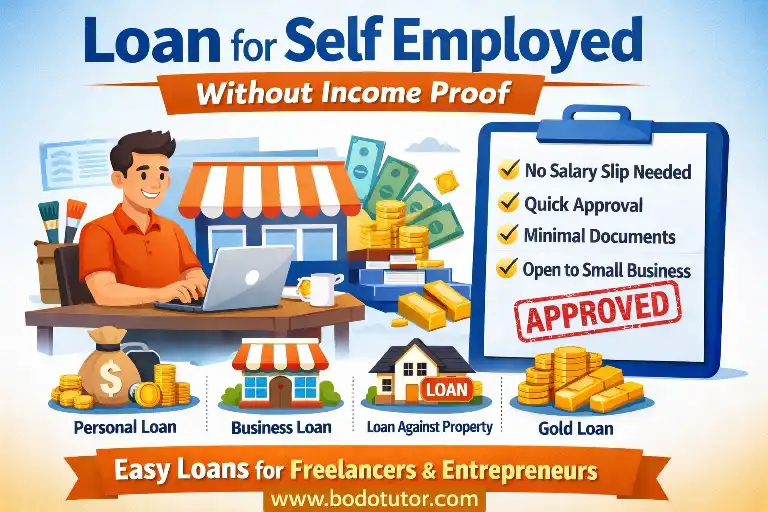

Getting a loan for self employed without income proof can be challenging, but it is not impossible. Many banks, NBFCs, and online lenders now offer loan options for self-employed individuals who do not have traditional salary slips or income certificates.

Loan for Self Employed Without Income Proof

In this article, you will learn:

- How self-employed people can get loans without income proof

- Types of loans available

- Eligibility criteria

- Interest rates and documents required

- Tips to increase approval chances

What Is a Loan for Self Employed Without Income Proof?

A loan for self employed without income proof is a type of personal or business loan offered to freelancers, shop owners, small business owners, traders, and professionals who do not have formal income documents like salary slips or Form 16.

Instead of income proof, lenders assess:

- Bank statements

- Credit score

- Business stability

- Transaction history

Who Can Apply?

This loan is suitable for:

- Small shop owners

- Freelancers & consultants

- Online sellers

- Self-employed professionals

- Traders & vendors

- Gig workers

Types of Loans Available Without Income Proof

1️⃣ Personal Loan for Self Employed

Offered based on bank statements and credit score.

2️⃣ Business Loan Without Income Proof

Designed for small businesses with regular cash flow.

3️⃣ Loan Against Property (LAP)

Lower interest rate if you own property.

4️⃣ Gold Loan

Quick approval without income proof.

5️⃣ Digital App Loans

Instant loans with minimal documentation.

Eligibility Criteria

Eligibility may vary by lender, but generally includes:

- Age: 21–60 years

- Credit Score: 650+ preferred

- Business Vintage: Minimum 1–3 years

- Bank Account: Active with regular transactions

- Indian Resident

Documents Required

Even without income proof, lenders usually ask for:

- Aadhaar Card

- PAN Card

- Bank statements (6–12 months)

- Business registration (if available)

- Address proof

- Passport size photos

📌 Note: Strong bank statements increase approval chances.

Interest Rate and Loan Amount

| Loan Type | Interest Rate | Loan Amount |

|---|---|---|

| Personal Loan | 12% – 28% | ₹50,000 – ₹20 lakh |

| Business Loan | 14% – 30% | ₹1 lakh – ₹50 lakh |

| Gold Loan | 8% – 14% | Based on gold value |

| LAP | 9% – 16% | Higher amount |

How to Apply for Loan Without Income Proof

1️⃣ Check your credit score

2️⃣ Maintain clean bank transactions

3️⃣ Compare lenders online

4️⃣ Apply with accurate details

5️⃣ Submit required documents

6️⃣ Complete verification

Many lenders provide instant approval and same-day disbursal.

How to Increase Loan Approval Chances

✔ Maintain minimum bank balance

✔ Avoid cheque bounces

✔ Reduce existing EMIs

✔ Apply with co-applicant (if possible)

✔ Choose shorter loan tenure

✔ Avoid multiple loan applications

Advantages of Loan Without Income Proof

- No salary slip required

- Fast approval process

- Available for freelancers & small businesses

- Flexible usage

- Online application facility

Disadvantages to Consider

⚠️ Higher interest rates

⚠️ Lower loan amount

⚠️ Strict repayment rules

⚠️ Penalties on late payment

Best Alternatives If Loan Is Rejected

- Gold loan

- Loan against FD

- Microfinance loans

- Peer-to-peer lending

- Government schemes for MSMEs

Final Words

A loan for self employed without income proof is a practical solution for individuals with strong cash flow but no formal income documents. By maintaining a good credit score and stable bank transactions, you can easily improve your chances of loan approval.

Always compare lenders, check interest rates, and read terms carefully before applying.

🔍 SEO Details (For Internal Use)

- Primary Keyword: loan for self employed without income proof

- Secondary Keywords:

- self employed loan without income proof

- business loan without income proof

- personal loan for self employed

- loan without salary slip

- Recommended Word Count: 1800–2200

- AdSense Safe: ✅

- High CPC & RPM: ✅

Also Read….

- Bad credit loan USA

- Business loan without collateral

- Debt consolidation loan

- Instant personal loan online